Indie Film Financing: A Deep Dive into Tax Credits, Rebates, and Grants

Indie filmmakers often find themselves racing against various hurdles, from tight budgets to resource constraints. Production budgets are slim, resources are scarce, and funding options can be challenging. However, one often overlooked resource can significantly impact the bottom line of indie productions – film tax credits, grants, and rebates.

In this blog post, we will dive into film incentives, highlighting each common type of incentive and their benefits for indie filmmakers, common misconceptions, and best practices for leveraging them for your next project.

What Are Film Incentives?

Film incentives encourage filmmakers to shoot their projects in specific locations (typically states). These incentives come in three main forms:

Tax Credits: Reduce the amount of owed taxes.

Rebates: Refund a portion of the spent amount post-production.

Grants: Provide financial assistance without necessitating repayment.

Why Indie Filmmakers Need Incentives

These incentives are not merely financial reliefs; they fuel the indie filmmaking process by mitigating financial risks and allowing filmmakers to focus more on the creative aspects of production.

However, many indie filmmakers and content creators are not using these incentives, often due to perceived barriers to entry or a lack of education on the matter.

Film incentives can be especially beneficial to indie filmmakers. Additionally, some states offer additional incentives, such as waiving specific permits or providing access to equipment and resources.

Cost Savings: The financial savings from tax credits can be the tipping point in getting a new project. Often, indie productions operate on razor-thin budgets, so every dollar counts.

Access to Better Equipment and Talent: Tax credits can give indie productions access to production specialists and technical expertise that may otherwise be out of reach. States want you to use their local talent and services and are willing to give significant returns if you do so. This can result in higher quality productions and a better chance of distribution by using resources typically out of your budget range.

Common Misconceptions About Film Incentives:

One common misconception about film tax credits is that only bigger productions qualify. However, this isn’t necessarily the case – many states also offer incentives to low-budget films, but the qualifications for such credits can vary.

Therefore, it’s essential to research your state’s film tax credit rules and regulations before applying for one. Additionally, some states have minimum budgets or production requirements that must be met to qualify for a credit.

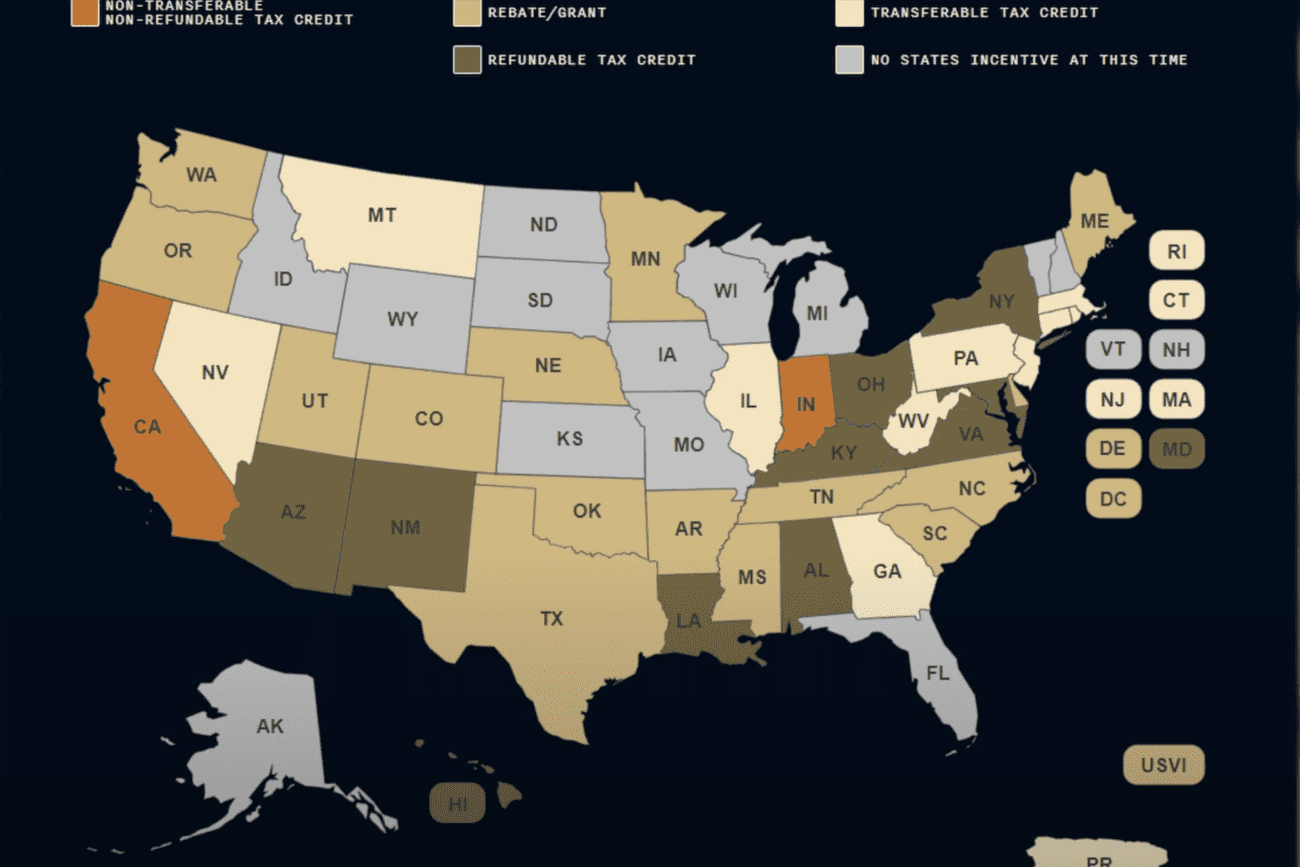

https://www.mediaservices.com/production-incentives/production-incentives-interactive-map/

In some cases, grants stand out as particularly impactful, not just for their financial non-reciprocal nature but also for their potential alignment with the thematic essence of a project. For example, an indie filmmaker creating a piece focused on climate change may find synergies with weather and climate organizations, potentially tapping into grants provided by entities whose objectives and messages resonate with the film’s core themes.

Financing Methods for Indie Filmmakers:

In addition to film tax credits and other incentives, many financing methods exist to help in your production. Don’t forget to look out for:

Private Investors: The most common method for financing Indie Films is through private or “angel” investors. Filmmakers offer these investors a share in the revenue in exchange for the funds needed to produce the project. Film Incentives, such as Tax Credits can be a huge benefit to these investors and show that you are using everything at your disposal to get them a return on their investment.

Crowdfunding: Crowdfunding is raising capital through the collective efforts of friends, family, fans, or individual investors. A common form of crowdfunding for indie filmmakers is donation/reward-based crowdfunding, in which a donor is given credit for your film or receives digital screeners. Indiegogo, Kickstarter, and Seed & Spark are the primary crowdfunding platforms for indie films.

Product Placement: An advertising technique in which a product or service is used in a film in exchange for financial support or return. Product placement can provide additional funding or lower costs for location-based shoots.

Chris Soriano, a previous guest of the Industry Insights podcast, leveraged his relationship with Pechanga Resort Casino to use their space for free on his second film.

Co-Productions: co-productions involve two or more production companies collaborating to produce a film, sharing not only creative input and resources but also costs, risks, and revenues.

Insider Tips and Best Practices:

To ensure that you get the most out of tax credits, here are some insider tips and best practices:

Contact the Local Film Commission to Learn More: They can provide up-to-date information on incentives, state regulations, union rules, and permits needed for production.

Hire a Tax Credit Consultant: A tax credit consultant can help navigate the process of obtaining and claiming credits and assess which credits apply to your production.

Keep Detailed Records: From pre-production to post-production, keep detailed records of all expenses related to the production. This will make it easier to claim your credits and offset production costs.

Work with the Indie Film Community: Indie filmmakers looking to bring their creative visions to life should consider leveraging the Indie Film Community for their next project. The struggle to secure distribution for indie films is a well-known challenge, and the Indie Film Community seeks to redefine this outdated model, paving the way for a future where indie films survive and thrive. Built with the specific needs of indie filmmakers, this community offers invaluable assistance in finding credible distributors, negotiating fair distribution agreements, and, if desired, aiding in self-distribution strategies.

Delving Deeper: Industry Insights Podcast

Consider tuning in to the Industry Insights podcast for a more comprehensive understanding of film incentives. This episode is a reservoir of knowledge, discussing the manifold aspects of film incentives and their implications for indie filmmakers.

Guest Jeff Deverett also shares his journey with SB 1421 and how he aims to make San Diego a film-friendly location for indie filmmakers to keep talent from leaving for other cities and states.

Conclusion:

In conclusion, film incentives are a powerful tool for indie filmmakers, offering cost savings with tax credits, a return on the amount spent through rebates, or free money in the form of a grant. New or inexperienced indie filmmakers can overlook these tools, or they may consider specific programs out of their reach.

However, with some work and guidance, indie productions can leverage these incentives to make their next project happen.

If you need additional guidance, consider checking out the Indie Film Community, a new program created by Jeff Deverett to help indie filmmakers with information, advice, and assistance.